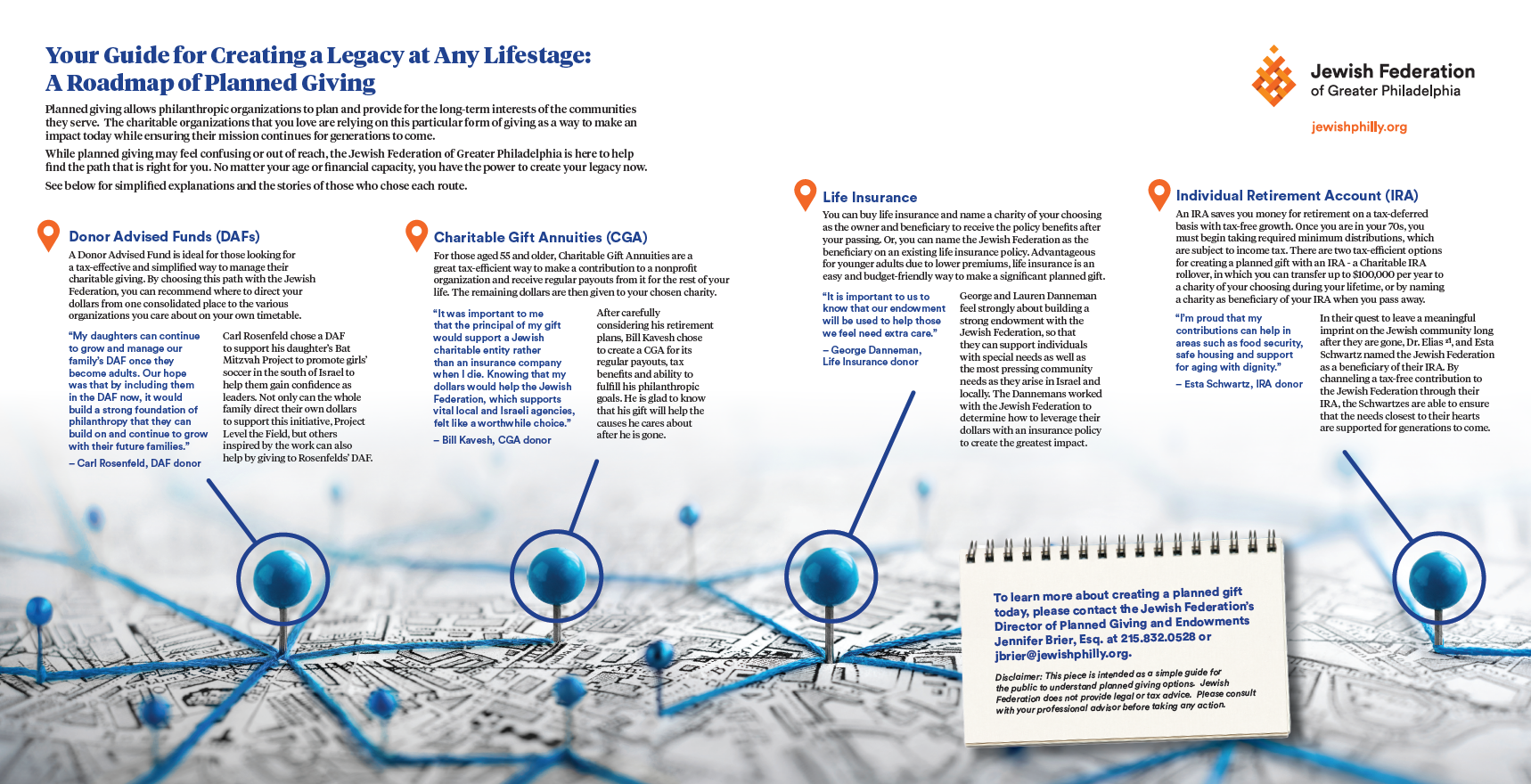

Planned giving allows philanthropic organizations to plan and provide for the long-term interests of the communities they serve. The charitable organizations that you love are relying on this particular form of giving as a way to make an impact today while ensuring their mission continues for generations to come.

While planned giving may feel confusing or out of reach, the Jewish Federation of Greater Philadelphia is here to help you find the path that is right for you. No matter your age or financial capacity, you have the power to create your legacy now.

In helping you navigate the various avenues of planned giving, see below for simplified explanations of various routes and the people who chose to take them.

Donor Advised Funds (DAFs)

A Donor Advised Fund is ideal for those looking for a tax-effective and simplified way to manage their charitable giving. By choosing this path with the Jewish Federation, you can recommend where to direct your dollars from one consolidated place to the various organizations you care about on your own timetable.

“My daughters can continue to grow and manage our family’s DAF once they become adults. Our hope was that by including them in the DAF now, it would build a strong foundation of philanthropy that they can build on and continue to grow with their future families.” - Carl Rosenfeld, DAF donor

Carl Rosenfeld chose a DAF to support his daughter’s Bat Mitzvah Project to promote girls’ soccer in the south of Israel to help them gain confidence as leaders. Not only can the whole family direct their own dollars to support this initiative, Project Level the Field, but others inspired by the work can also help by giving to Rosenfelds’ DAF.

Charitable Gift Annuities (CGA)

For those aged 55 and older, Charitable Gift Annuities are a great tax-efficient way to make a contribution to a nonprofit organization and receive regular payouts from it for the rest of your life. The remaining dollars are then given to your chosen charity.

“It was important to me that the principal of my gift would support a Jewish charitable entity rather than an insurance company when I die. Knowing that my dollars would help the Jewish Federation, which supports vital local and Israeli agencies, felt like a worthwhile choice.” - Bill Kavesh, CGA donor

After carefully considering his retirement plans, Bill Kavesh chose to create a CGA for its regular payouts, tax benefits and ability to fulfill his philanthropic goals. He is glad to know that his gift will help the causes he cares about after he is gone.

Life Insurance

You can buy life insurance and name a charity of your choosing as the owner and beneficiary to receive the policy benefits after your passing. Or,you can name the Jewish Federation as the beneficiary on an existing life insurance policy. Advantageous for younger adults due to lower premiums, life insurance is an easy and budget-friendly way to make a significant planned gift.

“It is important to us to know that our endowment will be used to help those we feel need extra care.” - George Danneman, Life Insurance donor

George and Lauren Danneman feel strongly about building a strong endowment with the Jewish Federation, so that they can support individuals with special needs as well as the most pressing community needs as they arise in Israel and locally. The Dannemans worked with the Jewish Federation to determine how to leverage their dollarswith an insurance policy to create the greatest impact.

Individual Retirement Account (IRA)

An IRA saves you money for retirement on a tax-deferred basis with tax-free growth. Once you are in your 70s, you must begin taking required minimum distributions, which are subject to income tax. There are two tax-efficient options for creating a planned gift with an IRA - a Charitable IRA rollover, in which you can transfer up to $100,000 per year to a charity of your choosing during your lifetime, OR by naming a charity as beneficiary of your IRA when you pass away.

“I’m proud that my contributions can help in areas such as food security, safe housing and support for aging with dignity.” - Esta Schwartz, IRA donor

In their quest to leave a meaningful imprint on the Jewish community long after they are gone, Dr. Elias, z’l, and Esta Schwartz named the Jewish Federation as a beneficiary of their IRA. By channeling a tax-free contribution to the Jewish Federation through their IRA, the Schwartzes are able to ensure that the needs closest to their hearts are supported for generations to come.

***

Disclaimer: This piece is intended as a simple guide for the public to understand planned giving options. Jewish Federation does not provide legal or tax advice. Please consult with your professional advisor before taking any action.

To learn more about creating a planned gift today, please contact the Jewish Federation’s Director of Planned Giving and Endowments Jennifer Brier, Esq. at 215.832.0528 or jbrier@jewishphilly.org.